estate tax changes effective date

We dont make judgments or prescribe specific policies. Current law provides that the individual estate and gift tax exemption will be reduced to 5000000 adjusted upwards each year for inflation in 2026.

Check These Tax Filing Deadlines Off Your To Do List

There are very few tax provisions in the act.

. Increase income taxeseffective January 1 2022. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. But certainly the drumbeat of change in.

The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act. Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022.

Other changes are set to be effective for transactions occurring on or after September 13 2021 including a 25 capital gains rate and having the sales. Learn How to Administer an Estate Manage Probate and Distribute Assets. Under current law the existing 10 million exemption would revert back to the 5 million exemption.

These graduated rates phase out for corporations with taxable income in excess of 10 million. Proposed Changes and Effective Date. The good news on this front is that the reduction of the estate and gift tax exemption from.

Reduction in Federal Estate and Gift Tax Exemption Amounts. 10000000 as adjusted for chained inflation presently 11700000 per person will be intact through the end of 2021. The AICPA told Congress about our concerns with the confusion the early sunset created.

The proposed effective date for the estate and gift tax changes would be for death and transfer after December 31 2021. Ad Step-By-Step Guides to Avoid Tax Penalties and Close the Estate Effectively. The effective dates of the newly enacted provisions generally are expected to be Jan.

2 increases the top capital gains rate from 20 percent to 25 percent for top marginal income tax brackets starting at 400000 for single filers and 450000 for joint filers effective September 13 2021 the date the Build Back Better Act was introduced. Without planning your best intents to properly distribute your estate might not be enough. The applicable exclusion amount from gift and estate tax currently is 117 million per taxpayer and is under current law set to revert to a reduced amount of 5 million per taxpayer adjusted for inflation effective January 1 2026.

The proposed plan will accelerate this sunset date to January. The change would be effective as of the date of enactment. 30 sunset of the Employee Retention Credit ERC.

As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any federal gift or estate tax. The effective dates of the newly enacted provisions generally are expected to be Jan. 3 subjects activeeffective January 1.

5376 and sent it to the Senate for consideration on Nov. The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022. See what makes us different.

January 1 2022 EstateGift Tax Exemption Cut in Half. Under current law this exemption is planned to sunset to 5 million adjusted for inflation on January 1 2026. The House passed the Build Back Better Act HR.

Currently the gift estate and GST tax exemptions are each 117 million per person for 2021. The bad news is it will be reduced to. The House Ways and Means Committee proposal accelerates this reduction lowering the exemption amount to 6020000 after the inflation adjustment effective as of January 1 2022.

A notable exception is the early Sept. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022.

The House Ways and Means Committee proposes to replace the flat 21 percent corporate income tax rate with graduated rates of 18 percent on the first 400000 of income 21 percent on income of up to 5 million and 265 percent on income thereafter. Ad Properly drafted estate plan does more than merely specifying what happens to your assets. The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022.

Cra T1135 Forms Toronto Tax Lawyer

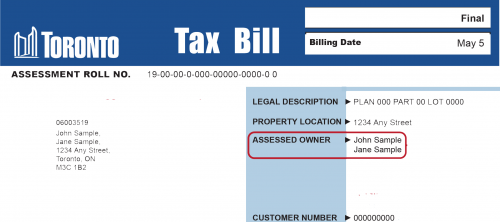

Buying Selling Or Moving City Of Toronto

How To Ask For A Promotion And Move Up The Career Ladder Investing Online Marketing Estate Planning

Personal Income Tax Brackets Ontario 2021 Md Tax

Closing Disclosure Calendar 2020 Image Calendar Examples How To Find Out Calendar

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Identifying The Acquisition Date Grant Thornton

Tax Update Canada Revenue Agency Prescribed Interest Rates Increasing July 1 2022 Mnp

Income Tax Law Changes What Advisors Need To Know

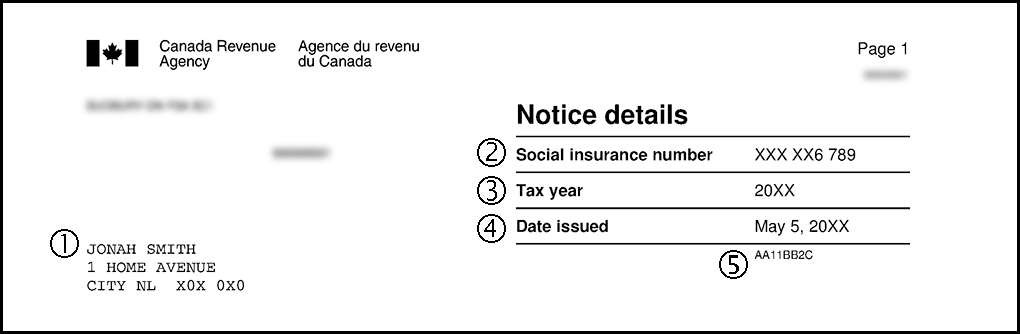

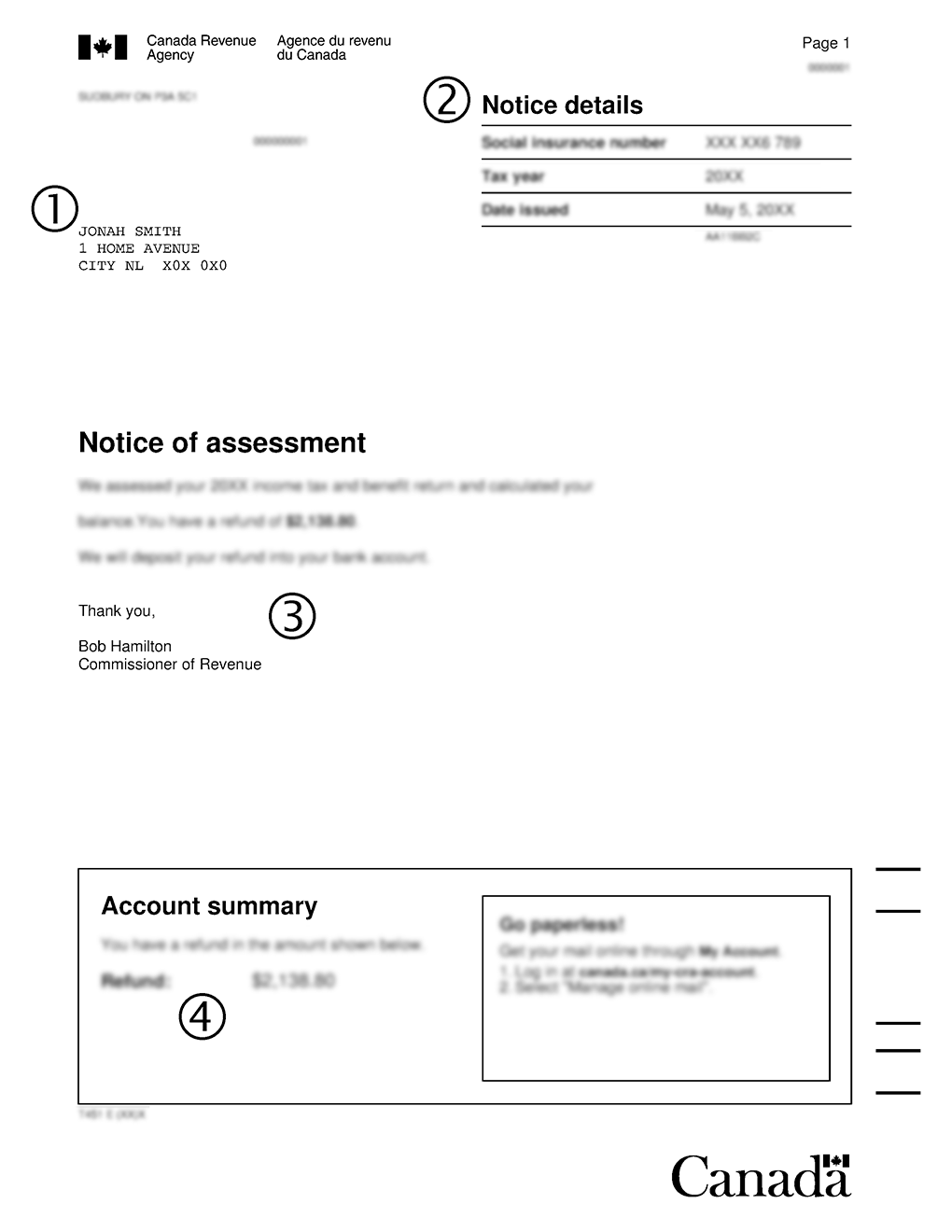

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Notifying Canada Revenue Agency Cra Of A Change Of Address 2022 Turbotax Canada Tips

Animal Rights Under Uae Law Sta Law Firm Law Firm Legal Services Intellectual Property Lawyer

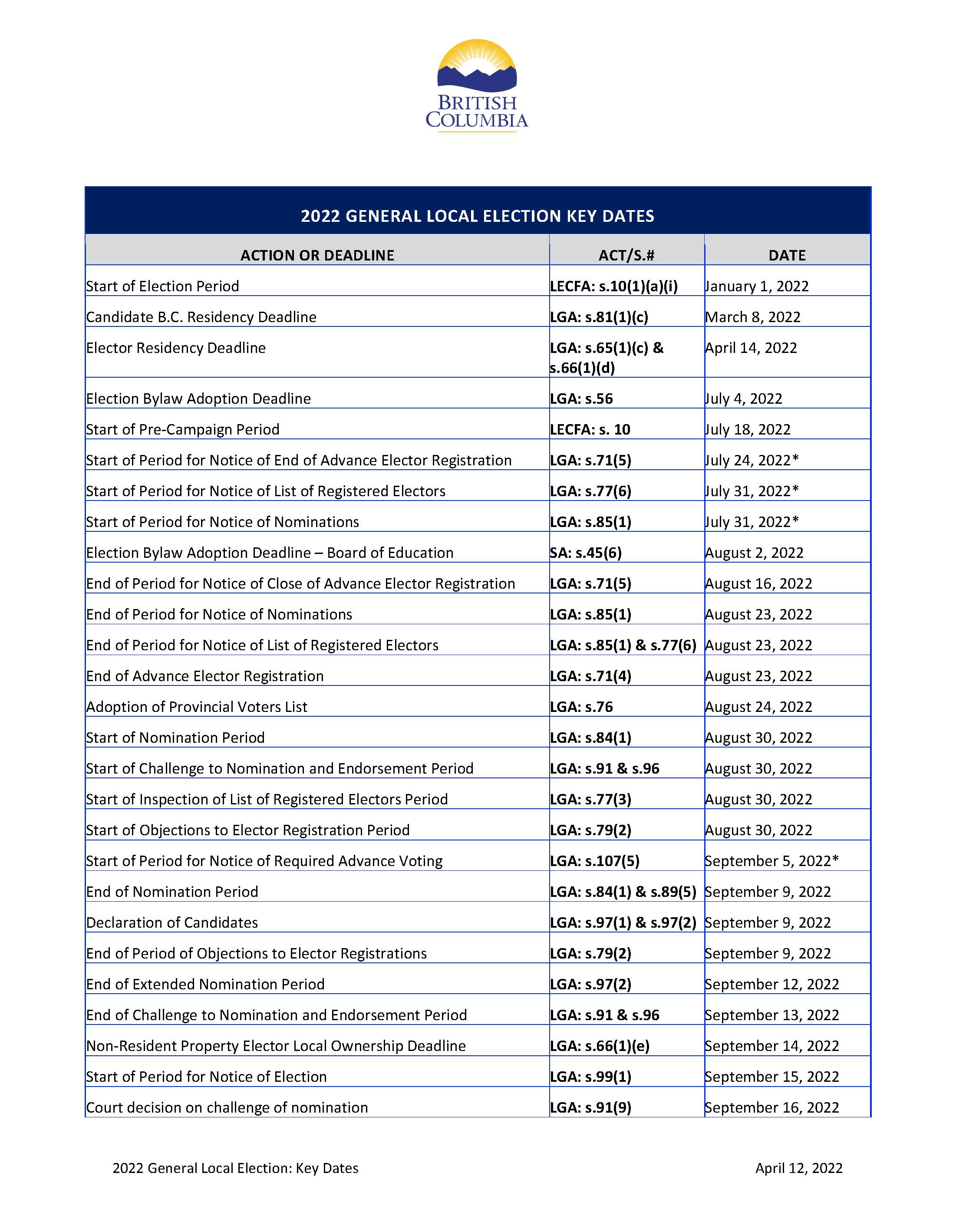

General Local Elections Calendar Province Of British Columbia

Identifying The Acquisition Date Grant Thornton

Operating Budget Example Business Budget Template Budget Spreadsheet Excel Budget Template

Estate Tax Law Changes What To Do Now

Financial Advisor Invoice Template Google Docs Google Sheets Illustrator Indesign Excel Word Apple Numbers Apple Pages Psd Pdf Template Net Invoice Template Financial Advisors Financial